Customize Your Tracking On QuickBooks

By: Rachel Raupp

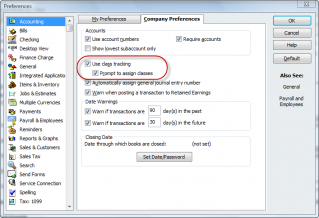

QuickBooks (QB) has this useful (and great) feature called “Class Tracking” that allows you track your income and expenses. We know what you’re thinking - another great feature?! QB is just too good to be true, we know, but the best part is that it is definitely, very much real. And it’s customizable! If you’re ready to go beyond account-based tracking (we recommend you do), we know just what you need.

Class Tracking lets you classify each of your transactions so you can see the profit and loss for your company in its entirety, but also lets you break these transactions down in categories that are meaningful to you and/or your business. Some breakdowns into categories could be by department, by business office or location, by separate properties you own, or any other significant breakdowns that are part of the business you do. For example, we have two office locations, Plymouth and Trenton, so we could create two separate classes for each location in order to track them individually.

You might be thinking “this is cool, but what’s the appeal? How does this benefit me?” Using Class Tracking allows you to see which parts of your business are bringing in the most money, which parts are doing well and which could use some work. This will be extremely useful when you sit down to create new goals or brainstorm ideas for improvement for your business.

QuickBooks Online and Desktop both offer Class Tracking and each have a user-friendly set-up process. We recommend that you create a generic category or “class” for items that don’t apply to any of your other specific categories. We usually call this generic category “Operations” or “Overheard.” This is where rent, utilities, phone bulls, and other maintenance transactions will go. You typically won’t want to track this class, but these transactions need a class assignment in QB. If you leave transactions unassigned, they’ll fall into the “Unclassified” class and you won’t know if it is an Operations item or if it should have been assigned to a specific class but was forgotten instead.

For easy, step-by-step instructions on how to create classes, click here. To go more in depth on class tracking (including how to make sub classes…yes, sub classes!), click here.

.png?token=6adcf38ed58846e4f05e97718ba6eb6d)