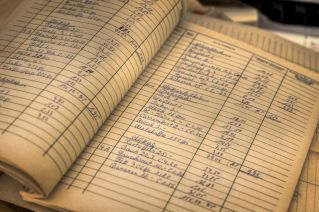

The Difference Between Single And Double-Entry Bookkeeping

If you’re sitting down to set up your books for the first time, you will need to choose between single or double-entry bookkeeping. Not sure what the difference is between the two and/or which to use for your business? Look no further!

Single-entry bookkeeping records only transactions and they are recorded in one column. This is similar to how you would record your expenses in your own personal checkbook. This style is not made for large or complex companies, but works for small and simple businesses that have little activity. A downside to single-entry bookkeeping is that is limits what you can do with your books. A balance sheet cannot be made from single-entry records, and you cannot track your asset or liability accounts. This will severely hurt your ability to look into your company further than surface-level.

Double-entry bookkeeping is the more common of the two, and it records both the debits and credits of your business in two columns and is listed in two accounts. A vital resource to a business is it’s financial records and all the information can be pulled from your double-entry accounting. Fraud is easy to detect in double-entry, and you’ll be able to accurately figure out your company’s profit and loss. If your business has regular activity, double-entry is best.

If you’re unsure which format to use or how to record your transactions, we’d love to help you set up your books correctly the FIRST time!

.png?token=6adcf38ed58846e4f05e97718ba6eb6d)