Three Common QuickBooks Mistakes Regarding Checks

By: Rachel Raupp

One thing we love about QuickBooks Desktop is there is more than one way to do things. However, we know the most efficient and productive way for entering any and all information. Today we’d like to address writing checks and share our advice for the most convenient route for you, and they will also keep your books flawless!

- Set Up an Automatic Payment Schedule For Loans

QB is great for entering bills and writing checks to make loan payments each month. However, instead of going to the Enter a Bill or Write a Check windows, a more convenient route is to go to Banking, then Loan Manager, and then Set Up a New Loan. Once this is finished, click the Set Up Payment option to finalize. Now you’re on track for QB to automatically enter the payment each month.

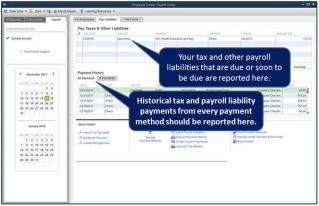

- Pay Payroll Taxes using the Pay Liabilities Window

When payroll is processed, QB will keep track of how much payroll tax your business owes and records this amount in Payroll Liabilities. Rather than paying your payroll taxes in the Write Checks window, we suggest making your payments directly from the Pay Liabilities window, which will make the necessary deductions and keep your books balanced. The same goes for paying sales tax - you should never just write a check. Make sure you pay it through the Pay Sales Tax Liability window.

- Only Enter Bills for Future Payments

If you plan on paying a bill immediately, write a check. You only need to enter a bill in QB if you do not plan on paying until a future date.

.png?token=6adcf38ed58846e4f05e97718ba6eb6d)